- The quantitative/qualitative easing policy that constitutes one pillar of Abenomics proved successful from the outset in realizing a cheaper yen and higher stock prices, and in halting deflation in Japan.

- Nevertheless, the inflation rate has continued to fall short of the 2% target and, although the Bank of Japan hurriedly expanded quantitative easing and introduced a negative interest rate policy, the effects have been minimal.

- The quantitative easing and the current negative interest rate policy sought primarily to boost the expectations of market participants, and their effectiveness was always uncertain.

- It is quite likely that quantitative easing through high-volume purchases of long-term bonds will cause the Bank of Japan enormous losses over the medium to long term, imposing burdens on taxpayers both directly and indirectly. If the current quantitative easing continues, the Bank of Japan may find itself in the near future unable to cover such losses even using all of its seigniorage profits.

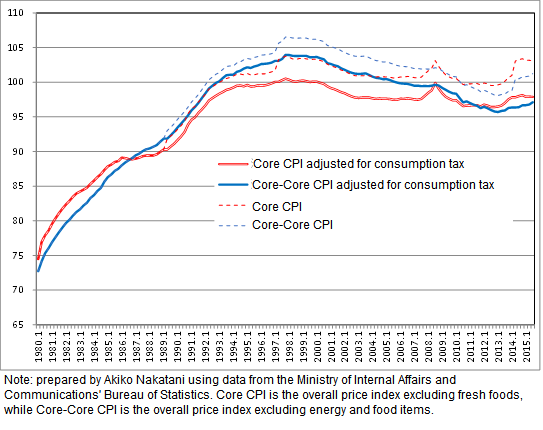

The BoJ's quantitative easing as a percentage of GDP far surpassed that undertaken by the US in the wake of the 2008 global financial crisis or by the European Central Bank (ECB) during the Greek financial crisis. This quantitative easing played to the expectations of market participants and had a significant impact on financial markets, causing the yen to drop in value and stock prices to rise. The decline in the yen's exchange value bolstered the performance of manufacturers and other companies by improving export profitability, and thus had a positive effect on stock prices. As a result, the Japanese economy succeeded to a great degree in making a recovery. Supply and demand in the labor market have substantially improved, and Japan continues to break out of deflation. In fact, consumer price indices (exclusive of consumption tax) had been declining from about 1998, but have made a slight upturn since about 2013 (Figure 1). However, the 2% inflation rate target has yet to be achieved in the three years since.

Figure 1. Consumer price indices

(pre-consumption tax adjusted CPI for 2010 indexed at 100)

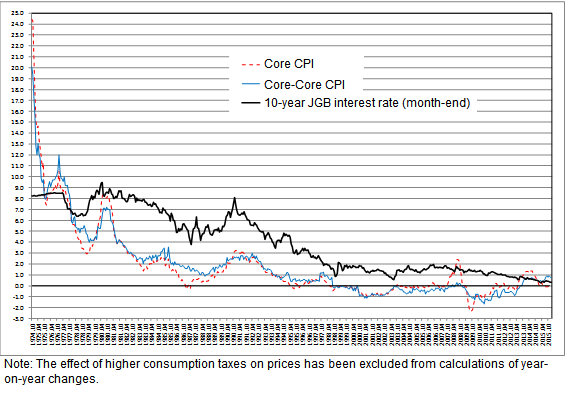

If the BoJ achieves its target of a 2% rise in consumer prices, it is very likely that interest rates will climb by at least 2 points or so. Figure 2 compares interest rates on 10-year JGBs with year-on-year rises in consumer prices from 1978 to 2015. Consumer prices are represented by the Core CPI, which just excludes fresh foods from the overall index, and the Core-Core CPI, which excludes food and energy, both of which are substantially impacted by import prices.

The BoJ uses the Core CPI to set its price index target, but this choice is problematic in a number of ways. The Core CPI rose substantially from 2007, when the prices of primary commodities surged just before the global financial crisis, through the first half of 2008, but subsequently plunged during the global financial crisis, showing that the Core CPI is more heavily affected by import prices than the Core-Core CPI and thus not suitable for use as the target of monetary policy.

Figure 2. JGB interest rates and year-on-year rises in consumer price indices

A rise in long-term interest rates will cause a considerable drop in the value of the BoJ's JGB holdings and losses to the BoJ. When announcing the expansion of quantitative and qualitative easing on October 31, 2014, the BoJ also make it known that it would increase its long-term JGB holdings by 80 trillion yen annually and extend the average remaining maturity of its JGB holdings from under three years (when easing started in 2013) to about 7 to 10 years. If JGB purchases continue at this pace, these holdings will total about 365 trillion yen at the end of 2016. If short- and long-term interest rates are 2 points higher at that time, the market value of the BoJ's JGB holdings with an average remaining maturity of 8 years will drop by about 14%, and the BoJ will incur enormous losses of around 51 trillion yen, more than 10% of Japan's GDP.

The BoJ's seigniorage will be roughly equivalent in present value to the balance of banknotes issued. If the BoJ procures funds by issuing cash at a zero interest rate and purchases JGBs, the present discounted value of the principal and interest earned by the BoJ from its JGBs will equal the balance of banknotes. If interest rates are about 2%, Japan's demand for banknotes will fall from 19% of GDP at present to less than 10% of GDP, and the BoJ's aforementioned losses would even exceed the present value of its seigniorage.

Monetary policies designed to stimulate the economy are usually thought not to incur fiscal costs. It is clear that tax cuts and expanded public expenditures produce government deficits that place greater burdens on future taxpayers but, because central banks enjoy the benefits of seigniorage, it might seem that no policy costs are incurred because JGB and other operations carried out via monetary policy are equivalent exchanges of bonds and banknotes. However, monetary policy can create huge fiscal burdens, depending on how it is implemented. A central bank must undertake buying operations to expand the monetary base and selling operations to shrink it but, if the JGBs and other instruments used in these operations are bought high and sold low, the central bank will suffer losses. The BoJ might be able to cover substantial losses using seigniorage, but the significant losses under current policy could exceed its ability to do so.

Approaches that might be adopted if the BoJ were to suffer unabsorbable losses include (1) increasing interest-bearing debt such as BoJ bills sold while continuing to generate deficits (i.e., ignoring deficits), (2) using the reserve requirement system to essentially have private-sector banks share the losses, and (3) maintaining zero interest rates even if prices rise considerably, but all of these ultimately will come at a very high cost to the Japanese public.

To sum up, the BoJ has exhausted the options available to it to stimulate the economy through monetary policy. In my view, the current quantitative easing policy has already exceeded the limit of the BoJ's loss-absorbing capacity. If further expansionary measures are necessary to stimulate the economy, the government will need to rely on structural policies such as a major change in immigration policy to invite foreign workers with strong Japanese language proficiency.

Reference

Mitsuhiro Fukao, "The Fiscal Costs of Quantitative Easing and NIRP, and Means of Addressing These Costs," Research Institute of Economy, Trade and Industry Discussion Paper, March 2016

Mitsuhiro Fukao has been a Professor of Economics in the Faculty of Business and Commerce of Keio University in Japan since 1997. His primary fields of expertise are financial regulations, international finance, monetary economics and policy. Fukao has abundant publications in Japanese and in English on international finance, exchange rate policy, corporate governance, and recently on financial system and its crisis. Prior to joining Keio University, Fukao was the Head of the Strategic Research Division of Research and Statistics Department of the Bank of Japan. During 1991-93, Fukao was a senior economist of the OECD in Paris and a G-10 secretary. In 1989 and 1990, he was a senior economist of the International Department of the Bank of Japan and a member of Danielsson subgroup of the Basel Committee on Banking Supervision. During 1983-85, Fukao served as a senior economist of the Economic Planning Agency of Japan and participated in drafting the official White Paper on Japanese Economy. Born in Japan, Fukao received his bachelor's degree in Engineering from Kyoto University in 1974. He was awarded a Ph.D. in Economics from the University of Michigan in 1981.

The views expressed in this piece are the author's own and should not be attributed to The Association of Japanese Institutes of Strategic Studies.