- Japan's electric machinery industry continues to lose out to global competition, with one local factory after another being shut down. The Japanese economy has heretofore rested on the twin pillars of the automotive and electric machinery industries, but a look at industrial statistics reveals that it has lost one of these pillars.

- Can Japan's automotive industry emerge from the current wave of major structural changes — the increasing introduction of electric vehicles and onboard AI as well as a shift from owning to sharing — and prove itself successful in global competition?

- The "Fourth Industrial Revolution" represents an opportunity for Japanese companies to make an enormous breakthrough, but they will sink if they fail to step up to the challenges at this critical juncture.

1. Structural problems in the Japanese economy

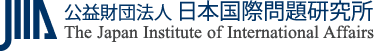

The structural problems plaguing the Japanese economy are a stagnation in capital investments and a lack of innovation. Japan's potential growth rate makes this quite obvious. Figure 1 shows that the growth of capital investments and total factor productivity have slumped to only a fraction of a percent since the turn of the century. The manufacturing industry's capital has become outdated, resulting in what is known as the "vintage problem." At the heart of the growth strategy designed to boost Japan's potential growth rate is the "Fourth Industrial Revolution." Abenomics led companies to increase their internal reserves by 100 trillion yen over a four-year period to an all-time high of 406 trillion yen at the end of 2016. The scenario envisioned by the Abe administration involves companies utilizing these funds to raise wages and stimulate demand, invest in Fourth Industrial Revolution sectors, and spark innovation. According to an OECD survey, Japan has ranked last in labor productivity among the seven major developed countries for the past 20 consecutive years, and it has fallen to 22nd place among the 34 OECD member countries. The Abe administration has asked the business community to raise wages by 3% in this year's "spring wage offensive," but corporate managers have been slow to act. Investments in Fourth Industrial Revolution sectors that spur productivity growth are expected to help wages increase.

Figure 1: Potential growth rate and breakdown of factors

Source: Bank of Japan.

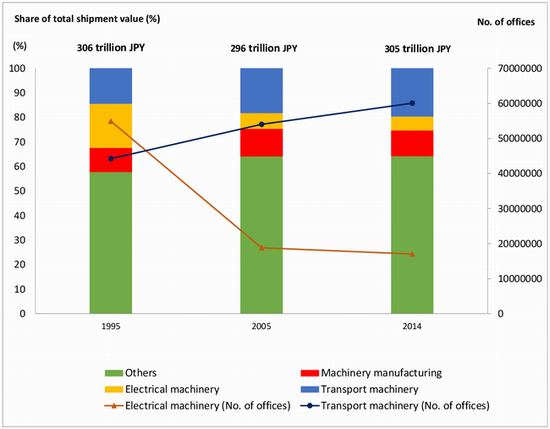

2. Japanese industry at a crossroads

In the two decades or so since Year 1 of the Internet (1995), the companies that have succeeded as big businesses — Google, Facebook, Amazon, Yahoo and the like — are all American firms. They built their big businesses quickly after start-up just by processing data rather than by manufacturing goods. The money paid for these services by Japanese consumers has accumulated in Silicon Valley, home to the headquarters of these companies, and created an unprecedented bubble. In the meantime, Japanese products have been disappearing among the personal computers and smartphones constituting the best-selling items in Japan. As illustrated by Panasonic's restructuring, Sharp's acquisition, and Toshiba's deteriorating business results, Japan's electric machinery industry continues to lose out in global competition, forcing it to close one local factory after another. The Japanese economy has heretofore been supported by two industries — the automotive and the electric machinery industries — having an extensive range of supporting industries, but industrial statistics show that one of these pillars has been lost (Figure 2). Can Japan's automotive industry emerge from the current wave of major structural changes — the increasing adoption of electric vehicles and onboard AI as well as a shift from owning to sharing — and prove itself successful in global competition?

Figure 2: Structural changes in Japanese manufacturing by decade

Source: Ministry of Economy, Trade and Industry.

According to Moore's Law, the changes over the next 20 years should be far greater than those experienced over the twenty years from Year One of the Internet to now. Today's smartphones are remarkably superior in performance even to the supercomputer that the author used at university as a student, and modern supercomputers will eventually become palm-sized and ubiquitous. That will give birth to an enormous market. Economics textbooks teach that the companies that enter such a market as soon as possible will gain a first-mover advantage and, consequently, companies around the world are frantically competing to seize this advantage.

In other words, the "Fourth Industrial Revolution" represents an opportunity for Japanese companies to make an enormous breakthrough, but they will be left behind if they fail to step up to the challenges; they now stand at a crossroads. The responses of companies over the next decade or two will lead to a drastic winnowing of winners from losers, something that will be experienced in all countries. This is why it is called a "revolution" and not a "reform."

3. Japanese companies starting to take up challenges

There are very few Japanese corporate managers with the ability to read the road far ahead, but a number of them are coming to the forefront. The "Dantotsu Plant Project" being pursued by Toyota parts supplier DENSO Corporation (President & CEO: Koji Arima; head office: Kariya, Aichi Prefecture; consolidated sales: 4.5271 trillion yen; consolidated workforce: 154,493), truly represents a Japanese "royal road." DENSO's "Dantotsu Plant" Project will be using IoT to link up 130 plants worldwide with the aim of boosting productivity by 30% over 2015 levels by 2020.

Efforts of one type or another are now underway at nearly all large companies, and these systems are likely to begin going into operation over the next few years. Nevertheless, small and medium-sized enterprises, which comprise 99.7% of all companies, have made no significant moves to invest in IoT. Asking the presidents of these companies about the reasons for their reluctance usually elicits expressions of doubt about what their companies should do and how they would benefit from IoT. Japan's overall economic productivity cannot be boosted unless this hurdle is cleared. Accordingly, the author hosted a "Study Group on Enhancing the Competitiveness of Small and Medium-sized Companies through IoT" that featured seven firms participating as model companies, and then published in book form an interim report on the discussions leading up to the adoption of IoT. Such valuable information is ordinarily kept within companies. Around a dozen of the 47 local governments that read this report will reportedly be budgeting funds in 2019 to start similar efforts in support of small local companies introducing IoT, thus giving the Study Group started by the author nationwide coverage, and the idea will likely spread to even more local governments next year. The US and Germany are also having a hard time getting small and medium-sized companies to adopt IoT and, to my best knowledge, few successful cases have emerged. It is thus quite possible that Japan will prove the most successful in this endeavor because seven model cases were successes thanks to the support of the Study Group, and this know-how is spreading across Japan.

4. Conclusion

Corporate managers at Japanese companies continued to cling to conservative management approaches for 20 years or so after the bubble collapsed, reasoning that there were no attractive investment destinations. For the first time in 20 years, though, that excuse no longer holds. Their enormous internal reserves can now be invested in the "Fourth Industrial Revolution." Japanese executives find themselves at a critical juncture, where their choices will determine whether the corporate ships they have heretofore steered on a conservative course will sink or enjoy smooth sailing ahead.

Koichi Iwamoto is a Senior Fellow at the Research Institute of Economy, Trade and Industry.

The views expressed in this piece are the author's own and should not be attributed to The Association of Japanese Institutes of Strategic Studies.